In the case of an audit, The Australian Taxation Office (ATO) can go back five years after your last lodged tax return. Following advances in technology, it is becoming increasingly important for clients to maintain accurate records and ensure these are adequately backed up. The following study was designed and conducted by Roz Lahey to gain insights related to tax returns and client honesty when it comes to declaring expenses. We surveyed 2000 Australians aged 18 and over to find out how honest they were when filling out their tax returns.

Key facts:

- Main finding: Majority of Australians have never “overestimated” their expenses to get more from their tax returns

- Those aged between 55 and 64 were the most honest but among those who cheated in this age group they did some by very large sums often over $1000

- Sample size: 2000 respondents

- Study period: February 11, 2016 – February 14, 2016

- Location: Australia

Respondents were asked the following question:

Have you ever “overestimated” your expenses in order to get more from your tax return?

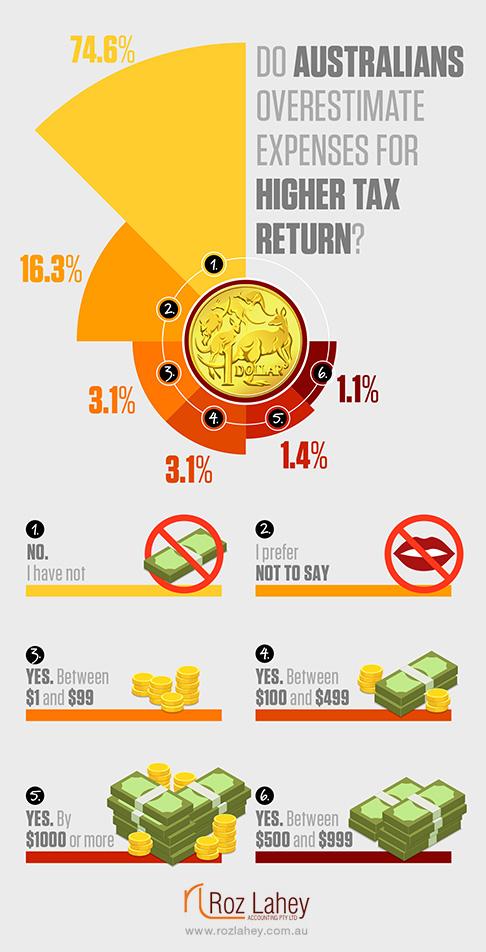

The results show that thankfully, the majority (74.6% of respondents) has never “overestimated” expenses when filling out tax returns, and only 1.4% overestimated this amount by $1000 or more.

Other responses included:

- 6.2% Yes, between $1 and $499

- 1.1% Yes, between $ 500 and $999

- 16.3% I prefer not to say

When breaking the answers down across different regions, we found that the most honest Australians come from the Northern Territory, with 100% of those respondents stating they have never “overestimated” expenses.

Furthermore, when breaking down results by age range, we found that the most honest age range was between 55-64 with 80.5% from that range answering “No. I haven’t”.

When taking a closer look at how many respondents from each age range respondent no, we found the following:

- 78.7% of those aged 18-24

- 74.7% of those aged 25-34

- 73.2% of those aged 35-44

- 73.1% of those aged 45-54

- 77.2% of those aged 65+

We can thus see that there was not a significant difference between age ranges or locations. Considering the importance of maintaining and declaring accurate information when it comes to your tax returns, these are positive results.

But why is it so important to be honest when reporting your expenses? We take a closer look at previous estimates made by businesses and individuals to detect any recent patterns, and whether or not there have been any increases or decreases in clients’ estimates over recent years.We also offer helpful advice and tips, including the crucial actions you should be taking when keeping and maintaining records, as well as when filling out your tax returns. This is vital information for both individuals and businesses to take into account.

What do you think are most important actions individuals and businesses should take to ensure they are safe in case of an audit?

One word – HONESTY. Keep accurate records of all sales and expenses. Run all transactions through a bank account. Make sure CASH SALES are accounted for and banked. Don’t put personal expenses through your business. Be aware that the ATO can audit five years after your last lodged tax return. Make sure your records are safe and can be produced if requested. The best way to face an ATO audit is being confident there is nothing they will find to incriminate you or your business.

Are there any patterns you’ve noticed with your clients when it comes to declaring their expenses?

Most clients do not deviate from the expenses they have previously claimed. They will present with receipts for similar expenses year after year. It is often accountants advice as to what extra expenses can legitimately be claimed within their line of work, and what records and source documents need to be kept.

Have you noticed any increases/decreases in clients’ estimates over the last one/two financial years?

If anything, I believe the average deductions are reducing based on auditing and data matching by the ATO. As technology is advanced, the ATO has far better access to client records.Therefore, taxpayers need to be aware if they forget about interest in a bank account or a government payment that was made, the ATO will find it and have the return amended to include. Under these circumstances, there is also the strong possibility of fines and interest payment for undue care taken with processing the tax return.

Are there any tips you have to offer when it comes to your clients backing up their data digitally?

Receipts and source documents can and do fade to the stage that they are unreadable. Given that the ATO can request receipts and records going back five years, we recommend our clients photocopy receipts and scan to a tax file for preservation. As for business databases, it is always recommended that a backup is off site – Cloud-based backups are secure and can be accessed anywhere and often by multiple computers.

Conclusion

The importance of honesty when it comes to filling out your tax returns cannot be stressed enough – and judging by the results of our survey, the majority of Australians seem to agree. To ensure you’re covered in the case of an audit, always be honest and don’t forget to take things such as interest and government payments into account.